Report by CBRE: E-Commerce in the Post-Pandemic Era in the CEE region

The pandemic had the potential to fundamentally alter the way we shop, by significantly accelerating the growth of e-commerce penetration, defined as the percentage of total retail sales in a market happening via online channels as opposed to in-store. In the recent CBRE´s report, they review whether CEE markets have experienced a lasting e-commerce growth effect as a result of COVID, and the associated implications for retail real estate.

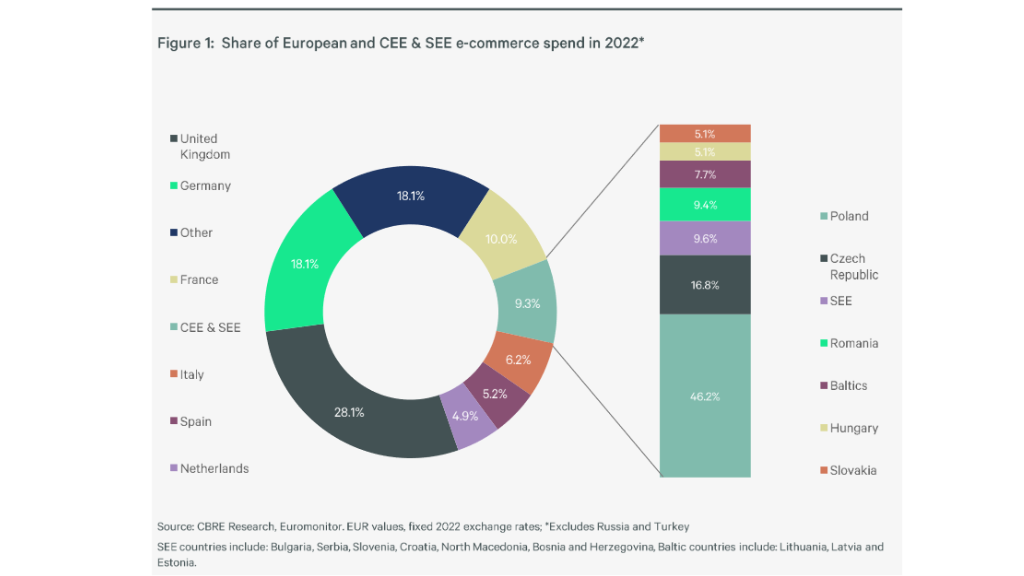

Among the CEE & SEE markets, there are vast differences in the share of total e-commerce spending. Poland is by far the largest market, and account for almost half (46.2%) of total spend in the region. Any change in the e-commerce share of total retail spending in this market will therefore have an outsized effect on total CEE & SEE spend. In contrast, Hungary, Slovakia, Baltics and SEE markets together account for around a quarter of spending in the region, meaning that an increase in e-commerce shares in these markets will have a smaller impact on the total amount spent.

The emerging Central and Eastern European e-commerce markets of Poland, Czech Republic, Romania and Hungary vary in their trend. While the Czech Republic and Romania are over a year behind its pre-COVID trend, Poland is 2.9 years ahead. From its pre-pandemic (Q4 2019) level to its pandemic peak, penetration in Poland jumped by 55%, compared with a 48% increase for the Czech Republic and 25% for Romania. Thanks to the high demand for out-of-home services, Poland and the Czech Republic have become leaders in the out-of-home parcel delivery market.

Markets which account for greatest share of spending return to trend

The UK and Germany are by far the largest e-commerce markets in Europe by amount spent, accounting for almost half of all spending in Euro (€) terms. Both of these markets have largely returned to trend, with Germany being 0.8 and the UK just 0.1 years ahead of its pre-pandemic trend as of Q3 2023. In the UK, the added growth above trend has generated approximately €27.3 bn of additional e-commerce sales.

However, Polish market which is responsible for 4% of total European e-commerce spend is the country which is the most years ahead of pre-COVID trend (except for Portugal). Other two CEE markets – Czech Republic and Romania are both behind the trend, both being responsible for limited European e-commerce spend – 2% and 1%, respectively.

As for Hungary, data source is available for a shorter period of time than for other countries, ending with 2022 data. As for Q4 2022, Hungary was, similar to Poland, also ahead of trend (3.1 years)

Downoad the e-paper HERE