European industrial volumes recovered 16% in Q1 2024

European industrial and logistics (I&L) investment increased 16% YoY during Q1 2024 to €8bn, versus €6.9bn in Q1 2023. With total CRE volumes reaching €37bn (-7% YoY), I&L comprised c.22% of the total. I&L volumes in Continental Europe were even stronger, rising 33% YoY to €6.3bn, as UK volumes fell 22% YoY.

The best performer was Belgium, where investment reached €862m, compared with just €33m in Q1 2023, boosted by a significant platform transaction. The Netherlands increased by 75%, driven by single asset deals, while Norway and Sweden recorded increases of 80% and 69%, respectively. Perhaps more significantly, Germany was 42% higher YoY at €1.5bn.

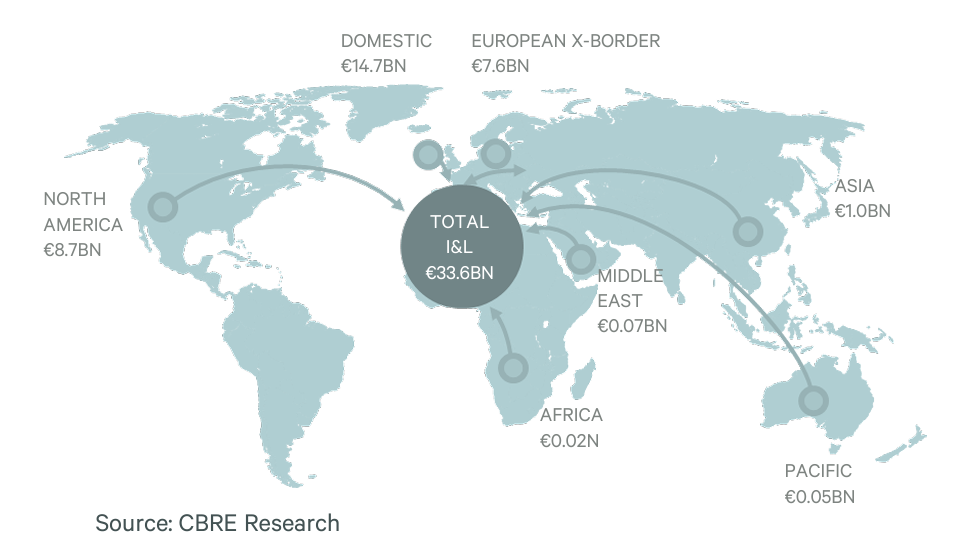

The main high-profile underperformer was the UK, but Spain (-45%) and Poland (-66%) were also lower. Volumes for the last 12 months are still 28% lower than the previous 12-month period (-34% for all CRE sectors) but were in line with the pre-pandemic trend and close to the 10-year average. The lower volumes seen in 2023 are also expected to improve the year-on-year comparisons by mid-2024. Single asset deals continued to dominate, with 52% of the total in Q1, even though the return of portfolio and larger transactions increased the average deal size. Of the €34bn of capital flows into European I&L in the last 12 months, 65% were from within Europe. Domestic volumes were 33% lower at €14.7bn but remained the largest capital source. Cross-border investment fell 23% and North American flows were down 17%, despite trebling in Q1 alone. Asian investment dropped 46% to €1bn. Valuations continued to stabilise in Q1, with yields moving out just 8bps on average and capital values increasing in Brussels and Barcelona, as primes rents increased.

Original article

Image source: mktgdocs.cbre.com